Today I’m sharing the most common retirement mistakes.

With pensions disappearing and life expectancy increasing, it’s more important than ever to avoid costly pitfalls.

In fact, one big mistake could force you to work longer or adjust your retirement goals.

It could also result in you leaving the IRS an unnecessary tip!

If you want to know what the biggest retirement mistakes are and how to avoid them, this guide is for you.

First, grab these free retirement resources (no email address required!):

- The 3 Pillars Successful Retirement Plans [PDF Worksheet]

- Master List of Financial Planning Goals [PDF Checklist]

The Most Common Mistakes When Planning for Retirement

For most of the 20th century, most American’s didn’t have to think much about saving for retirement. The employer you worked for the majority of your career often took care of it for you.

It must have been great to not have to worry about avoiding retirement pitfalls, or making any of the biggest retirement mistakes we’re going to cover today … right?

Well, maybe.

The truth is, there’s a reason retirement planning barely existed in recent history. Tougher living conditions with fewer medical treatments meant shorter life expectancies. This left far fewer people with the luxury to retire at all.

As cited in “The New Retirementality” by Mitch Anthony:

“When [President Franklin D. Roosevelt] and the New Dealers settled on the age of 65 in 1935, the average life expectancy in America was 63 years.”

For better or worse, things are different now.

Most boomers have the opportunity—and the obligation—to prepare for a longer, healthier, and more amply funded retirement than their grandparents could ever dream of.

That’s good news. But now, in place of “Papa Pension Plan” acting as your guardian, we have an ever-evolving array of employer- and government-devised retirement saving incentives. They can help you go far, but they can also quickly become a confusing challenge.

Let’s cover the 9 most common retirement mistakes boomers should avoid.

Retirement Mistake #1: Failing to Adopt a Systematic Income Distribution Process

Have you and your advisor established a reliable distribution process to help you spend comfortably in retirement?

You and your spouse could be in retirement for decades, across a range of inflation risks and market conditions. Nobody wants to even think about running out of money before their time. But neither should you have to live on bread and water if you can comfortably afford more. So, failing on this front can be one of the worst retirement mistakes of all.

What’s a retiree to do?

You may have heard of the classic “4% rule,” introduced by William Bengen in 1994. Basically, Bengen’s rule suggested you could expect to live in retirement indefinitely without depleting your nest egg, as long as you began by spending 4% of your wealth annually, adjusted annually for inflation.

While this may be a starting point for your retirement-spending conversation, subsequent research has improved on this early, one-size-fits-all solution. Depending on your unique circumstances and the market conditions you happen to encounter in your lifetime, it may not fit so well after all.

Especially if you encounter a down market in the early years of your retirement, you may experience a “double whammy” of starting to spend down your portfolio while share prices are dropping. This is referred to as sequence risk, and it can hit your nest egg’s future growth potential particularly hard.

Hopefully, sequence risk won’t happen to you. But based on the market’s demonstrated random walk combined with “Murphy’s Law,” it’s best to assume it could, and be prepared to respond accordingly.

Building on conventional retirement spending plans, we suggest a systematic rules-based retirement income distribution strategy for maintaining sustainable spending, come what may.

The strategy still begins with a set of initial portfolio management and withdrawal rules. Then, it adds a pair of spending “guardrails” to keep your retirement ball rolling down the middle of the proverbial lane. One rail represents an annually applied “capital preservation rule,” to reduce your odds of overspending in retirement. The other establishes a “prosperity rule,” to prevent the opposite extreme of living far more frugally than needed.

If you’d like to explore the methodology in greater detail, we’re happy to schedule a time to do so. You also can reference this landmark Journal of Financial Planning paper, “Decision Rules and Maximum Initial Withdrawal Rates.”

Retirement Mistake #2: Failing to Plan

Of course, the best way to retire according to plan is to have a plan to begin with.

- What’s a reasonable amount of money to retire with, for you and your retirement goals?

- What are your retirement goals?

- How much does the average 66-year-old have saved for retirement, and how does that compare to your own retirement savings?

- How long do you think your retirement will be?

- What if I’m unable to work as long as I hope to? On the flip side, how might a part-time job in retirement enhance my financial security?

- What are your estimated living expenses, today and tomorrow?

- Where will the money come from?

Perhaps it’s human nature to postpone these sorts of arduous, but essential planning questions until your retirement nears. When you’re mid-career, it’s a whole lot more fun to plan your next vacation than to grind out sensible saving plans that won’t prove out for decades.

And while there are free, do-it-yourself retirement calculators online to help you assess where you stand, they can feel like random guesstimates, at best.

No wonder we’ve listed failure to plan as the number one retirement planning mistake people make.

It’s tempting to put it all off for another day instead of recruiting a reputable financial planner to help you crunch some realistic numbers.

That being said:

- How else will you create a tax-wise plan for what, where, and how much to save and invest toward retirement—while spending on joyful living today?

- Who else will help you implement and stay true to your plans—no matter how many careers you may burn through, or bear markets you endure?

- How else will you know whether you are saving enough—or too much?

Retirement Mistake #3: Saving Too Little … Or Too Much

Young investors can super-charge their employers’ retirement plan programs along with the market’s long-term efficiencies to feed their retirement nest egg. By the time you reach full retirement age, this gives you your best odds for sitting pretty.

If you wait until mid-career to even think about it, you’ll need to scramble up a steeper, shorter saving slope, without as many compound returns (i.e., returns generating more returns) to exponentially accelerate the effort.

You may need to save more than is comfortable, work longer than you’d like, downgrade your spending goals, and/or take on more investment risks in pursuit of higher returns. That last tactic can put you even further behind if near-term markets happen to deliver more risks than rewards.

Enough said about starting early. Believe it or not, saving too much for can be a big retirement mistake as well.

What if you’ve been super-saving and stashing away tax-sheltered dollars and corporate benefits galore, without ever taking stock of where you stand?

With the right planning, you might be able to loosen up and live larger today if you know your retirement goals are already well ahead of schedule.

Bottom line, the longer you put off calculating and adhering to sensible retirement saving goals, the more uncertainty you’re injecting into your future and current spending plans.

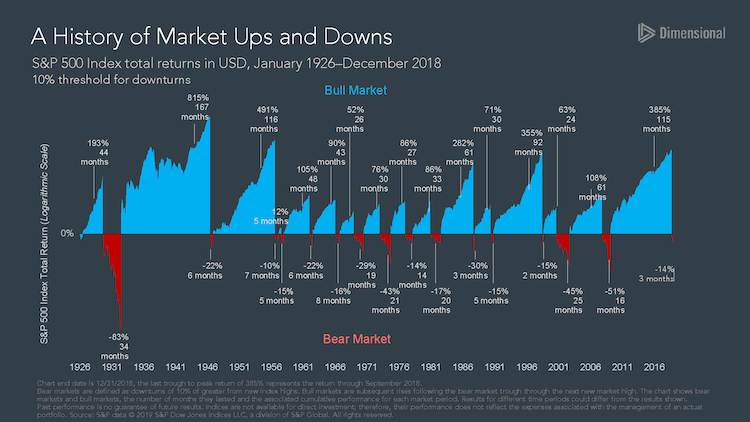

Retirement Mistake #4: Not Planning for Bear Markets and Recessions

Are you failing to prepare for the impact market downturns can have on your best-laid plans?

That can be another big retirement mistake.

Over the long haul, you can expect the market to deliver inflation-busting returns on your retirement investments. But to earn those returns, you must expect—and be willing to endure—the inevitable market downturns you’ll encounter along the way.

For that, you’ll want to have a plan in place, to avoid overreacting to how severe and lengthy a bear market can be.

We suggest preparing for these sorts of transitory uncertainties by investing in low-cost mutual funds or ETFs according to plan, and then staying invested according to plan.

That’s because the strongest market returns have a way of showing up when you least expect them.

Think about the dramatic April 2020 U.S. stock market surge following the February-March bear market that same year. Still in the thick of the coronavirus pandemic, few would have predicted a rapid rise versus a continued decline at that time.

Assets earmarked for retirement usually have a long timeframe and a tax-sheltered environment in which to grow, so you want to let them ride out the squalls along the way to higher expected returns. In place of denial and/or panicked reaction to adverse markets, a solid, upfront investment plan helps you stay the course.

Retirement Mistake #5: Buying Into Investment Smoke & Mirrors

In place of disciplined planning, another common retirement planning mistake is to fall for sales pitches promising all the retirement income you need, guaranteed.

Popular products (often priced accordingly) include:

- Junk bonds with high yields

- Dividend-paying stocks

- Variable annuities

- Alternative products that promise consistently higher returns with little to no extra risk involved

We understand the appeal. Who wouldn’t want some of that?

There’s just one problem. Once you look past the promotional smoke and mirrors, this risk/reward combination rarely, if ever, exists. Either way, it typically costs you a pretty penny to pursue.

A clear, evidence-based view of investment science informs us: To pursue higher market returns, you must accept more market uncertainty. To reduce the uncertainty, you must lower your return expectations. It’s as simple as that.

The solution?

Choose an appropriate balance between risk and expected returns, and do what you can to minimize the costs involved in implementing it.

Ignoring underlying expenses is another big mistake that can cost you far more than any benefits promised. Once you move past the slick sales pitches, it only makes sense to pay more if you’re receiving enough value in return.

The first question on that front is: What are you actually paying?

Wall Street has made a science out of burying/hiding fees in places you’re unlikely to notice them. A fiduciary financial professional who is on your side can show you where to look and help you avoid this common retirement mistake.

Retirement Mistake #6: Carrying High-Interest Debt Into Retirement

By the way, are you carrying excessive debt loads?

Credit card balances and similar high-interest debt can place a significant drag on your ability to even keep pace with inflation, let alone accumulate inflation-busting wealth over time.

It’s a mistake to weigh yourself down with too much of this sort of debt. Developing a plan to pay it off as soon as possible, before you enter into retirement, is a powerful way to shore up the stability of your retirement spending reserves.

Whether to pay off a low-interest mortgage is a more nuanced discussion.

In low-rate environments, retaining a mortgage can free up assets that might otherwise be tied up in your home. You can then put these assets to work for you in the stock market, earning expected higher returns.

That said, there’s also the “peace of mind” factor to consider. Even if it may not be the theoretically ideal use for the assets, you may simply prefer knowing the roof over your head is bought and paid for—no matter what else may happen in your life. Plus, if you reduce or pay off your home mortgage before you retire, the extra home equity can become a source for emergency funds, should the need arise.

Retirement Mistake #7: Tapping Into Retirement Accounts Early

It’s often assumed, once you retire, your spending will magically plummet, along with your income tax. That may be true to a degree.

Depending on how you plan it, you could find yourself in a lower tax bracket in early retirement, and there may be many costs you can cut once your time is your own.

That said, you’re also likely to encounter significant expenses you must plan for in life after retirement. For example:

- You may incur new costs related to healthcare and long-term care insurance. (Medicare may not cover as much as you might hope for.)

- You may still want to spend as much or more on your favorite leisure-time activities.

- While your earned income may decline, judicious tax planning may warrant deliberately incurring some taxable capital gains in early retirement, to reduce your tax burden in the long run.

- It may be time to revisit your sources for emergency funds.

How will you cover these and other expenses, potentially for decades?

It can be a mistake to promptly swap out your paycheck for all those tax-sheltered assets you’ve been building for years. Like a jigsaw puzzle, your retirement spending “pieces” may at first seem like a random assortment. But they can form a complete picture if you take the time to put each one in its proper place.

For example, there are your main (taxable) investments, 401(k) plan assets, IRAs, Roth IRAs, and Health Savings Accounts (HSA). There’s Social Security. If you’re lucky, there may be a pension plan or two.

There also are any number of ways each piece can contribute to—or detract from—your overall tax consequences. For example:

- Roth withdrawals are tax-free (because you paid the taxes upfront), as are qualified HSA withdrawals.

- Tapping into your traditional IRA or 401(k) generates ordinary income taxes.

- If you’re a couple, there are relatively complex rules that call for carefully coordinating your Social Security claiming strategies.

- Spending taxable assets in lower-tax years may make more sense than using up your tax-free resources soon.

- There also are estate planning considerations if you’d like to pass on remaining wealth to loved ones as a tax-efficient inheritance.

- If you’re charitably inclined, a donor-advised fund may also help.

Bottom line, it’s a mistake to randomly deploy your various sources of retirement income too soon. Before you begin tapping into your reserves willy-nilly, take the time to bring your ideal spend-down plans into view with careful tax, financial, and estate planning.

Retirement Mistake #8: Hiring the Wrong Financial Advisor

If we haven’t made it clear by now, there is tons to think about, plan for, and respond to as you prepare for your ideal retirement.

Once you do retire, you’ll need ongoing planning to most efficiently spend down your reserves. On both counts, you’ll want to hire the right financial advisor to help you find your balance.

If you live in or near Seattle, we’ve created a “Top Seattle Financial Advisors” guide, with some “how to” ideas to help you get started.

In general, seek the following qualities:

- Independent: Your financial advisor shouldn’t be beholden to anyone besides you, their client.

- Fee-only: Their sole source of compensation should be your fees. They should not be receiving kick-backs for selling you one product or service over another.

- Experienced: They should be retirement planners, with a deep bench of talent in this specialized area of financial planning.

- Fiduciary: Their top priority should be advancing your highest financial interests across everything they do for you.

Retirement Mistake #9: Retirement Planning by Any Other Name

What if you’re not the retiring type? Does this paper still apply to you?

Yes, it does!

Not everyone ends up retiring. Berkshire Hathaway’s Warren Buffett, age 90, and his 97-year-old sidekick Charlie Munger are still going strong. Madeleine Albright, age 83, just published her most recent book last year.

82-year-old Nobel laureate and financial economist Eugene Fama once wrote:

“I love my work. I have no intention of stopping as long as I’m breathing—and I may even do it after that.”

Good for them. But even if you, like them, are planning to work until you run out of breath, it still makes sense to strike an appropriate balance between spending as abundantly as you can today, while preserving enough wealth for you and your loved ones to enjoy in the future. As such, you can apply these same “retirement” mistakes to your ongoing planning.

Would you like to continue this retirement conversation with us directly?

To help potential clients make an educated and informed decision about our firm, we’ve designed a no-cost, no-obligation five-step process we call “Sleep On It.”

“Will You Run Out of Money in Retirement?”

Get this question answered (and more!) through our complimentary Sleep On it Process™.

This 6-step process will let you know where you stand in the four key areas of retirement + help you evaluate our firm.